ohio sales tax exemption form contractor

Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of. Generally a contractor does not collect sales tax from their customer on the performance of a real property construction contract.

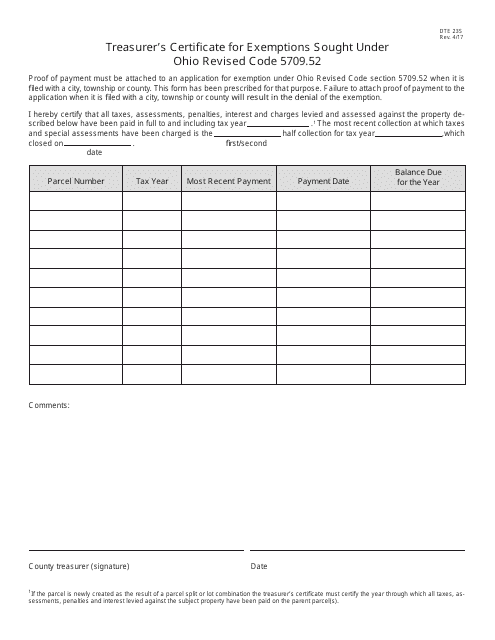

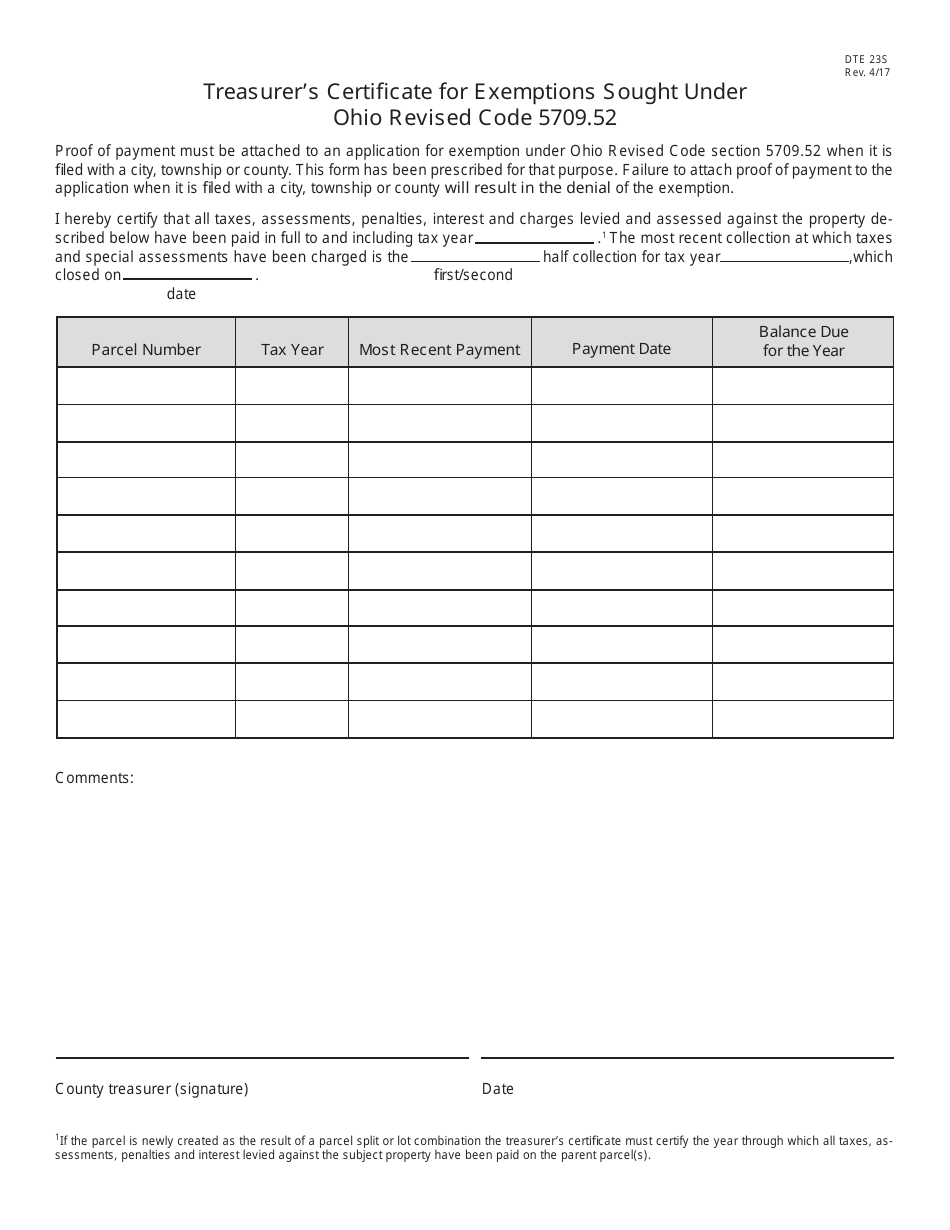

Form Dte23s Download Printable Pdf Or Fill Online Treasurer S Certificate For Exemptions Sought Under Ohio Revised Code 5709 52 Ohio Templateroller

Current through all regulations passed and filed through May 6 2022.

. 2019 the Court of Appeals of Ohio held that Karvo Paving Co. Sales and use tax. The buyer can benefit from the exemption by using this certificate when purchasing the goods material etc.

Ad Sales Tax Exemption Form information registration support. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors. A building under a construction contract with an organi-zation exempt from taxation under section 501c3 of the Internal Revenue Code of 1986 when the building is to be used exclusively for the organizations exempt purposes.

They do however pay sales tax on the supplies they purchase. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax. New State Sales Tax Registration.

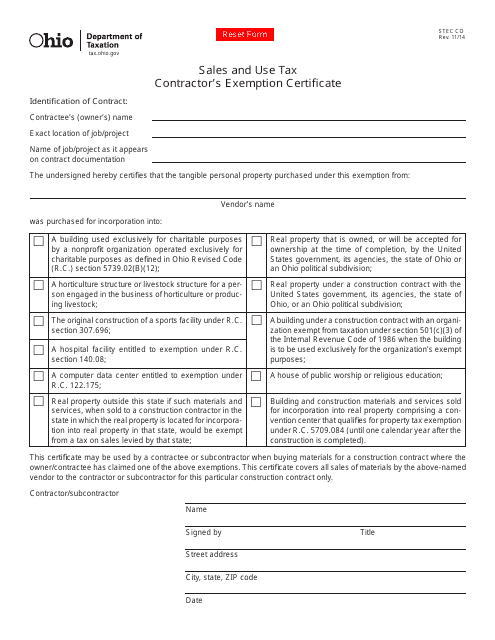

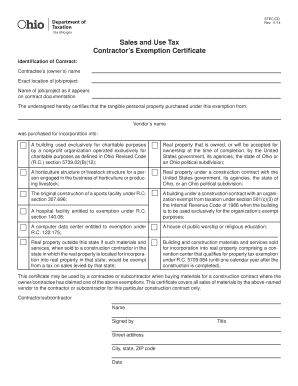

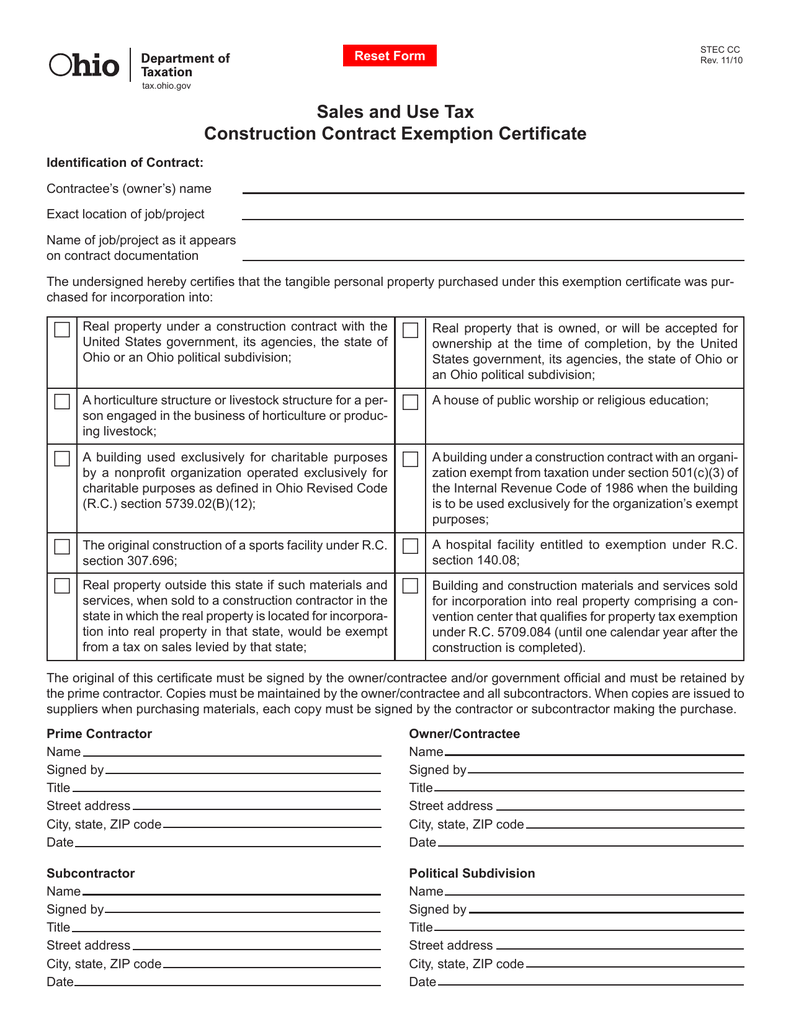

Available on the Ohio Department of Taxations website is the form STEC CC which is the construction contract. Ad Download Or Email STEC CO More Fillable Forms Register and Subscribe Now. A hospital facility entitled to exemption under RC.

A contractee claiming one of the above exemptions must execute the Construction Contract Exemption Certificate available on the Ohio Department of Taxations website. Sales Tax in Construction. 1 PDF editor e-sign platform data collection form builder solution in a single app.

Exempted by Ohio Revised Code Section 573902 B-1 Ohio Department of Transportation. In addition to requiring purchaser information such as name address and business type Ohio. Sales and Use Tax Blanket Exemption Certificate.

If a contractor does not pay Ohio sales tax on the tangible personal property to its supplier then it generally owes. A computer data center entitled to exemption under RC. 2 Get a resale certificate fast.

Real property outside this state if such materials and services when sold to a construction contractor in the state in which the real property is located for incorpora-tion into real property in that state would be exempt from a tax on sales levied by that state. Taxohiogov Sales and Use Tax. 2 When claiming exemption under paragraph D1 of this rule the contractee and contractor must issue exemption certificates in accordance with paragraphs I and J of this rule.

With either rule 5703-9-10 or 5703-9-25 of the Admin- istrative CodeThis certificate cannot be used by construction contractors to purchase material for. E A construction contractor who also makes substantial sales of the same types. Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement.

Contractors purchasing goods to install in a tax-exempt project should use this form. Did not owe sales tax on employment services provided by an. Section 5703-9-14 - Sales and use tax.

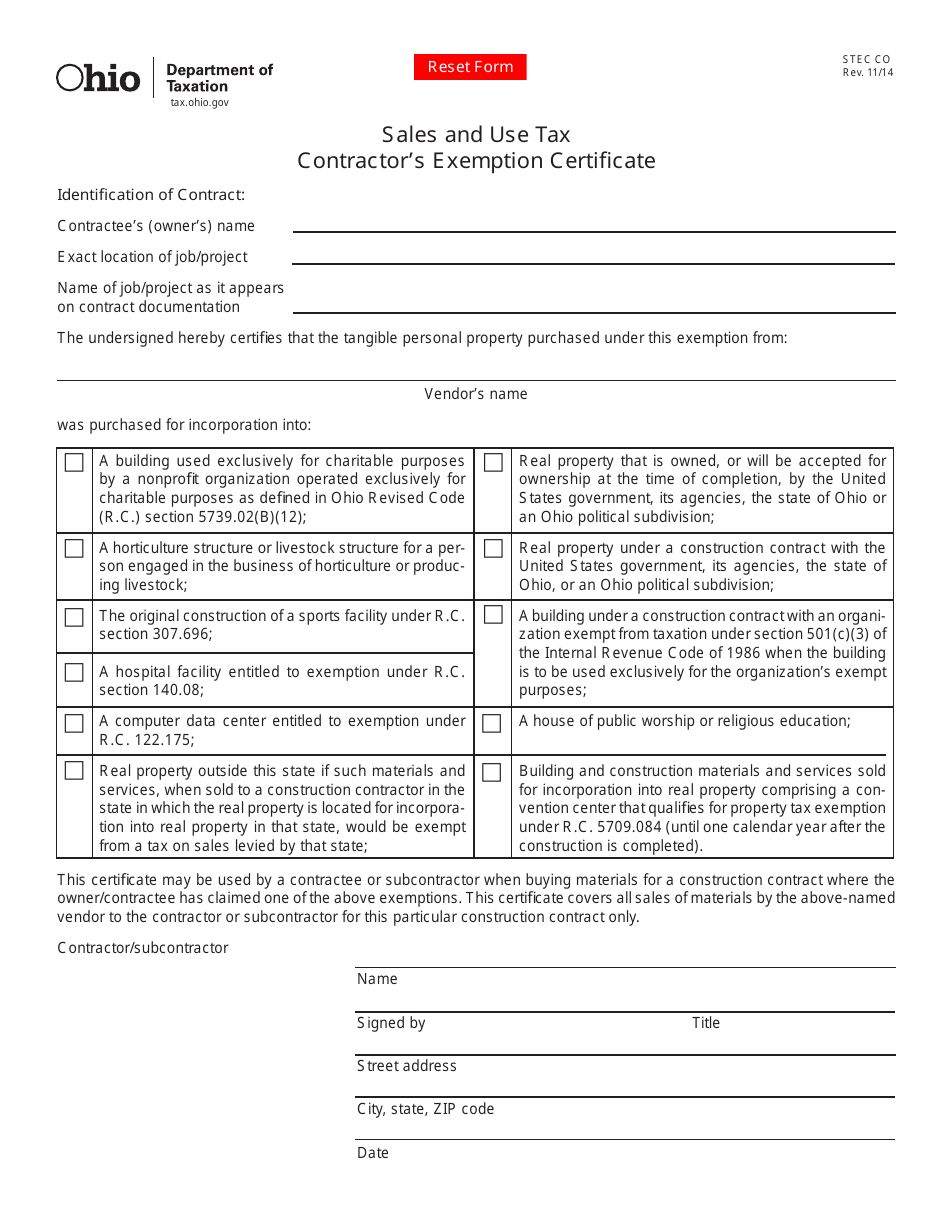

The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. You can download a PDF of the Ohio Contractors Exemption Certicate Form STEC-CO on this page.

Contractors and home remodelers do not collect sales tax on their work. The contractee shall be deemed to be the consumer of all materials and services purchased under the claim of exemption and liable for the tax on the incorporated materials or services in the event the tax commissioner ascertains that the contractee was not entitled to exemption. A computer data center entitled to exemption under RC.

Sales and Use Tax Blanket Exemption Certificate. The goods in question should form an integral form of the end structure or reside within the completed structure. Ohio law provides that contractors are consumers of the tangible personal property that they install into real property.

Exemption certificatesAA construction contract is any agreement written or oral pursuant to which tangible personal property is or is to be transferred and incorporated into real property as. As the consumer the contractor is re sponsible for paying sales or use tax on the purchase of the tangible personal property to be installed. Are not subject to sales and use tax.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Construction contractors must comply with rule 5703-9-14 of the. How to use sales tax exemption certificates in Ohio.

The contractee assumes liability for any unpaid taxes. For other Ohio sales tax exemption certificates go here. Instead of charging the.

Goods or materials bought for the construction of projects for certain agencies departments etc. Testa 145 NE3d 1221 Ohio App. Karvo did not owe sales or use tax on traffic maintenance equipment it installed while performing Ohio Department of Transportation ODOT contracts.

Ad 1 Fill out a simple application. The contractor may purchase the tangible personal property exempt from sales tax in this situation as a sale for resale. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract.

The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. This form is updated annually and includes the most recent changes to the tax code.

In Karvo Paving Co. Construction contractors must comply with rule 5703-9-14 of the Administrative Code. While consumers expect to pay sales tax when purchasing tangible goods many services also generate sales tax revenue for the state of Ohio.

This certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. For other Ohio sales tax exemption certificates go here. Construction contractors must comply with rule 5703-9-14 of the.

At the time of publication the Ohio sales and use tax rate is 55 percent. For real property jobs the contractor is considered the consumer of the materials installed and must pay sales or use tax at the time the materials are purchased. If you take your car in for repairs in Ohio expect to be charged sales tax on the mechanics labor.

A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. Istrative CodeThis certificate cannot be used by construction contractors to purchase material for incorporation into real property under an exempt construction contract. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock.

A contractor is then protected from liability if it is later determined that the contract did not qualify for exemption. Historic Courthouse 91 North Sandusky Street Delaware Ohio 43015 Map It.

Fill Free Fillable Forms City Of Dublin Ohio

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Ohio Sales Tax Small Business Guide Truic

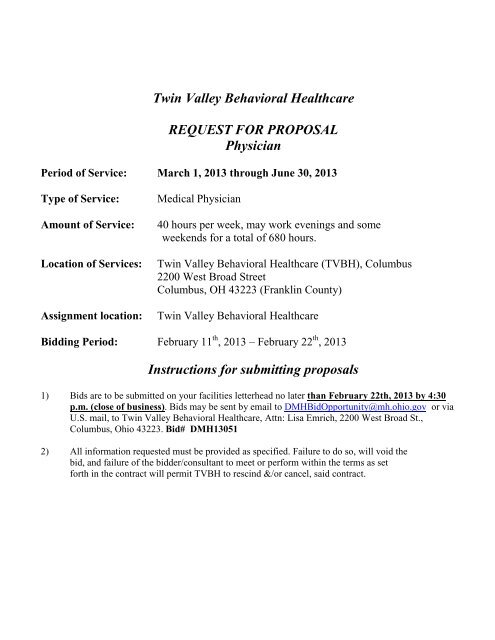

Twin Valley Behavioral Healthcare Request For Proposal

Contract Tax Certificate Form Fill Out And Sign Printable Pdf Template Signnow

Sales And Use Tax Construction Contract Exemption Certifi Cate

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Fill Free Fillable Forms City Of Dublin Ohio

Fill Free Fillable Forms City Of Dublin Ohio

Sales And Use Information For Vendors Licensing And Filing Department Of Taxation

Construction Contract Department Of Taxation

Form Stec Co Download Fillable Pdf Or Fill Online Contractor S Exemption Certificate Ohio Templateroller

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Form Dte23s Download Printable Pdf Or Fill Online Treasurer S Certificate For Exemptions Sought Under Ohio Revised Code 5709 52 Ohio Templateroller